Contents

09 May 2025 • 18:10

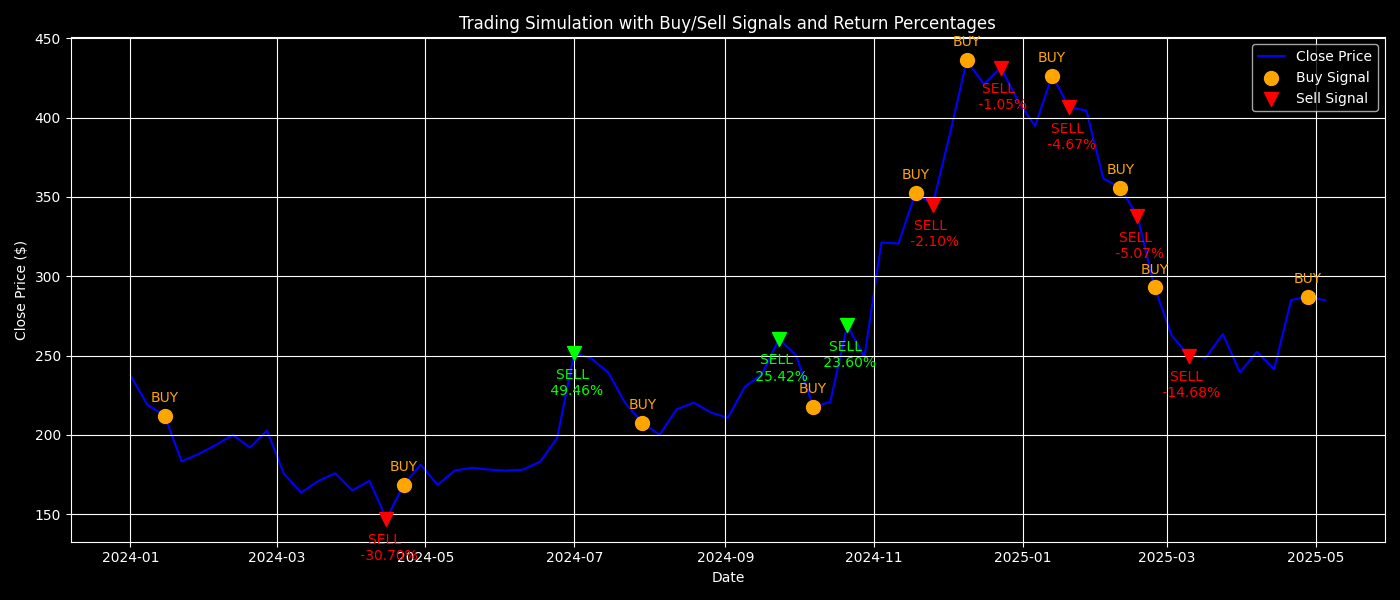

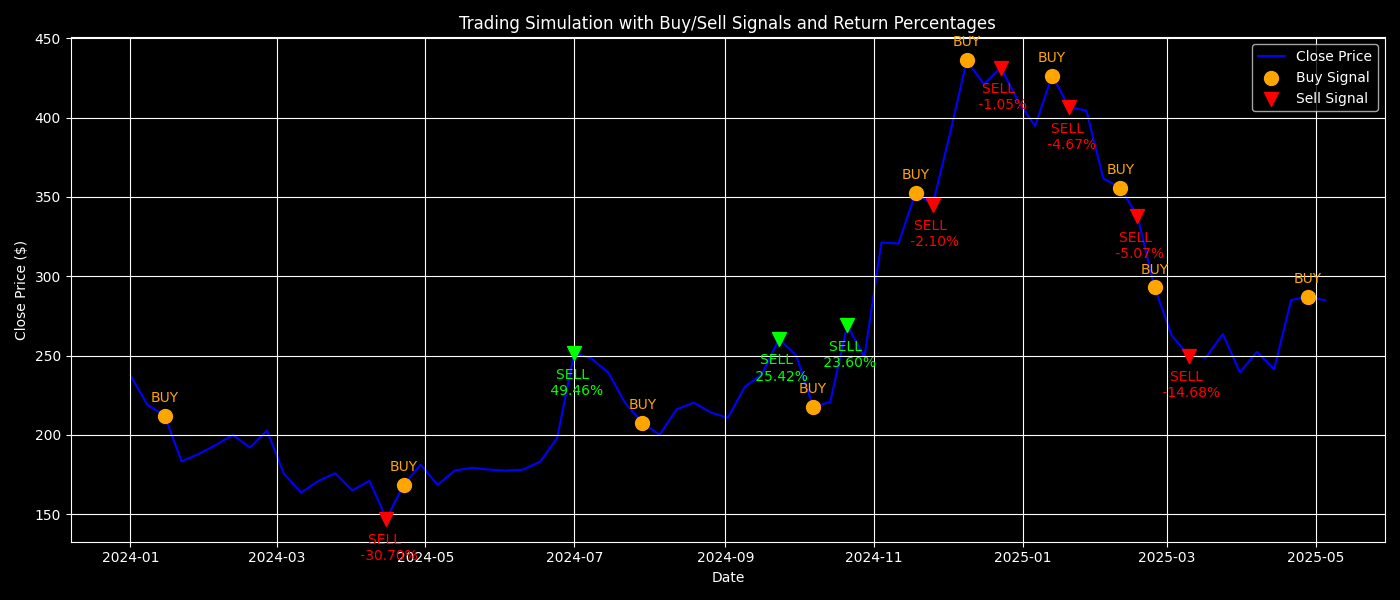

Trading Simulation with Buy/Sell Signals and Return Percentages

In this article, we are going to simulate a stock market trading strategy using a Random Forest model to predict stock price movements.

Specifically, we will use predictions for when to buy or sell shares, starting with a balance of $10,000. The goal is to evaluate the performance of the strategy over time, tracking both profits and the portfolio’s value.

This article is a continuation of my previous project, where we built a Random Forest model to predict stock price movements based on historical data.

If you’re interested in the details of how the model was trained, feel free to check out the full explanation in my Medium article and the code available on my GitHub repository.

We use a Random Forest model to predict whether the stock price will go up or down, based on features like the Open, Close, Volume, Low, and High prices.

The predictions are used to make simulated buy and sell decisions, applying a transaction fee and tracking the portfolio value over time.

Initial Portfolio: We start with $10,000 in virtual cash.

Buy Decision: We buy the stock when the model predicts that the price will go up.

Sell Decision: We sell the stock when the model predicts that the price will go down.

Transaction Fees: A small fee of 0.1% is applied to both buy and sell actions.

Position Tracking: We track both fractional shares and portfolio value to assess the overall performance.

Below is the code that simulates the stock trading strategy based on the predictions of the Random Forest model.

You can find the complete code in my GitHub repository.

The following code installs the necessary libraries that allow us to retrieve stock data, build plots, and handle model predictions.

%pip install joblib yfinance matplotlib tabulate --quietWe import the libraries we need for data manipulation, visualization, and model prediction.

import joblib

import yfinance as yf

import matplotlib.pyplot as plt

from tabulate import tabulate

plt.style.use("dark_background")Here, we use joblib to load the trained Random Forest model, yfinance to fetch stock data, matplotlib for visualizations, and tabulate for displaying trading results in a table.

We retrieve the most recent stock data for the company of interest (in this case, Tesla, identified by its ticker symbol TSLA) to simulate the trading strategy.

This is the same company for which the Random Forest model was trained. The data used for simulating the strategy was not part of the training or test set.

The data is downloaded with a weekly interval for analysis similar to the interval used for training.

ticker = "TSLA"

interval = "1wk"

# Load latest data for simulation

df = yf.download(ticker, start="2024-01-01", end="2025-05-08", auto_adjust=True, interval=interval)

df = df[['Open', 'Close', 'Volume', 'Low', 'High']]

df.dropna(inplace=True)

df.head()Here, we are fetching data for Tesla from January 2024 to May 2025 with a weekly interval.

This code generates a plot of the stock’s closing price over time, allowing us to visualize the stock’s movement.

plt.figure(figsize=(14, 6))

plt.plot(df.index, df["Close"], label="Close", color="blue")

plt.title("Closing Price Over Time")

plt.xlabel("Date")

plt.ylabel("Close Price (USD)")

plt.legend()

plt.grid(True)

plt.savefig("Close.png")

plt.show()Here, we plot the Closing Price of the stock using matplotlib, which helps to visualize the data and spot patterns or trends.

TSLA Closing Price Over Time

Next, we load the trained Random Forest model using joblib. This model will be used to make predictions based on the features we've prepared.

# Load the model from the file

model = joblib.load('random_forest_model.pkl')

# Use it to make predictions

predictions = model.predict(df)By loading the trained model, we can now use it to predict whether the stock will go up or down based on the input features.

We add the model’s predictions to the dataset. A Prediction column is created, which indicates whether the model predicts the price will go up (1) or down (0).

# Predict using trained model

df["Prediction"] = model.predict(df)

df.columns = df.columns.get_level_values(0)

df = df[['Open', 'Close', 'Volume', 'Low', 'High', 'Prediction']]

df.head()The predictions provide us with signals for when to buy (when Prediction == 1) and when to sell (when Prediction == 0).

In this step, we visualize the predicted market direction alongside the stock’s closing price.

# Plotting Close Price and Predictions

plt.figure(figsize=(14, 6))

# Plot the Close Price for the entire period

plt.plot(df.index, df["Close"], label='Close Price', color='blue')

# Plot predicted "Up" signals (where Prediction == 1)

plt.plot(df.index[df["Prediction"] == 1],

df["Close"][df["Prediction"] == 1],

'^', markersize=10, color='g', label='Predicted Up')

# Plot predicted "Down" signals (where Prediction == 0)

plt.plot(df.index[df["Prediction"] == 0],

df["Close"][df["Prediction"] == 0],

'v', markersize=10, color='r', label='Predicted Down')

# Set the chart title and labels

plt.title("Predicted Market Direction vs Close Price")

plt.xlabel("Date")

plt.ylabel("Close Price ($)")

# Add a legend to differentiate the signals

plt.legend()

# Show grid for better visualization

plt.grid(True)

# Save the plot as a .png file

plt.tight_layout()

plt.savefig("predicted_market_direction.png")

# Display the plot

plt.show()This plot helps us visually compare the predicted market direction (up or down) against the actual stock price movement.

Predicted Market Direction vs Close Price

This section simulates how the model’s predictions would perform if used in a basic trading strategy.

The logic is straightforward: if the model predicts the stock price will increase the next day, the strategy buys shares; if it predicts a decrease, the strategy sells any shares currently held.

The simulation tracks key metrics including:

Available cash

Number of shares held

Transaction fees

Portfolio value over time

This kind of backtesting allows us to estimate how well our prediction model might perform in a real-world trading scenario.

While it’s a simplified simulation (it doesn’t account for slippage, market spread, or liquidity), it provides a useful benchmark for model performance.

We begin by setting up the initial state for the simulation:

Starting with $10,000 in virtual cash

Holding no shares initially

Keeping a transaction log of each trade

Charging a 0.1% transaction fee per trade (buy or sell)

# Simulate trading strategy

virtual_cash = 10000 # starting balance in dollars

position = 0 # total number of shares held (fractional allowed)

trade_log = []

buy_price = 0 # To track the price at which we bought shares

transaction_fee_percentage = 0.001 # 0.1% fee

# Loop through the data to simulate trading based on predictions

for i in range(len(df) - 1):

price = df.iloc[i]["Close"]

next_pred = int(df["Prediction"].iloc[i]) # Predict the action (1 = buy, 0 = sell)

# Buy if predicted to go up and we have enough cash

if next_pred == 1 and virtual_cash >= price:

# Calculate the maximum shares we can buy after accounting for fees

shares_bought = virtual_cash / (price * (1 + transaction_fee_percentage))

cost = shares_bought * price

fee = cost * transaction_fee_percentage

total_cost = cost + fee

virtual_cash -= total_cost # Deduct cost including fee

position += shares_bought

buy_price = price

# Calculate current portfolio value

portfolio_value = virtual_cash + (position * price)

trade_log.append(("BUY", df.index[i], price, shares_bought, 0, portfolio_value, fee))

# Sell if predicted to go down and we hold shares

elif next_pred == 0 and position > 0:

proceeds = position * price

fee = proceeds * transaction_fee_percentage

net_proceeds = proceeds - fee

virtual_cash += net_proceeds

return_percentage = ((price - buy_price) / buy_price) * 100

portfolio_value = virtual_cash # After selling, only cash remains

trade_log.append(("SELL", df.index[i], price, position, return_percentage, portfolio_value, fee))

position = 0

# Display trade log using tabulate for better visualization

headers = ["Action", "Date", "Price", "Shares", "Return (%)", "Portfolio Value ($)", "Fee ($)"]

print(tabulate(trade_log, headers=headers, tablefmt="grid"))+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| Action | Date | Price | Shares | Return (%) | Portfolio Value ($) | Fee ($) |

+==========+=====================+=========+==========+==============+=======================+===========+

| BUY | 2024-01-15 00:00:00 | 212.19 | 47.0805 | 0 | 9990.01 | 9.99001 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| SELL | 2024-04-15 00:00:00 | 147.05 | 47.0805 | -30.6989 | 6916.26 | 6.92319 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| BUY | 2024-04-22 00:00:00 | 168.29 | 41.0562 | 0 | 6909.35 | 6.90935 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| SELL | 2024-07-01 00:00:00 | 251.52 | 41.0562 | 49.4563 | 10316.1 | 10.3265 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| BUY | 2024-07-29 00:00:00 | 207.67 | 49.626 | 0 | 10305.8 | 10.3058 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| SELL | 2024-09-23 00:00:00 | 260.46 | 49.626 | 25.4201 | 12912.7 | 12.9256 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| BUY | 2024-10-07 00:00:00 | 217.8 | 59.2276 | 0 | 12899.8 | 12.8998 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| SELL | 2024-10-21 00:00:00 | 269.19 | 59.2276 | 23.595 | 15927.5 | 15.9435 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| BUY | 2024-11-18 00:00:00 | 352.56 | 45.1316 | 0 | 15911.6 | 15.9116 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| SELL | 2024-11-25 00:00:00 | 345.16 | 45.1316 | -2.09893 | 15562.1 | 15.5776 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| BUY | 2024-12-09 00:00:00 | 436.23 | 35.6383 | 0 | 15546.5 | 15.5465 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

...

| SELL | 2025-03-10 00:00:00 | 249.98 | 47.2332 | -14.6768 | 11795.5 | 11.8074 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+

| BUY | 2025-04-28 00:00:00 | 287.21 | 41.0284 | 0 | 11783.8 | 11.7838 |

+----------+---------------------+---------+----------+--------------+-----------------------+-----------+This simulation executes a simple, rule-based strategy:

Buy if the model predicts an upward movement and we have enough cash

Sell if the model predicts a drop and we’re holding any shares

At each step, the portfolio value is updated and the transaction (with fee and returns) is logged

After simulating the sequence of trades, we calculate the final portfolio value to assess the performance of the strategy over time.

# Calculate final portfolio value and return percentage

final_price = df.iloc[-1]["Close"] # Last closing price

final_value = virtual_cash + (position * final_price) # Final value of portfolio

profit = final_value - 10000 # Profit or loss from initial investment

return_percentage = (profit / 10000) * 100 # Return as percentage

# Print final results

print(f"Final Portfolio Value: ${final_value:.2f}")

print(f"Profit/Loss: ${profit:.2f}")

print(f"Return: {return_percentage:.2f}%")Final Portfolio Value: $11685.71

Profit/Loss: $1685.71

Return: 16.86%This step provides a snapshot of the strategy’s outcome:

Final portfolio value includes both remaining cash and the market value of any unsold shares.

Profit/Loss is computed relative to the initial capital.

Return percentage reflects the overall profitability of the strategy.

To gain further insight into how the portfolio performed throughout the simulation, we plot the portfolio value after each buy or sell decision.

# After the trading loop

portfolio_values = [trade[5] for trade in trade_log]

dates = [trade[1] for trade in trade_log]

# Plot portfolio value over time

plt.figure(figsize=(14, 6))

plt.plot(dates, portfolio_values, label="Portfolio Value", color="purple")

plt.title("Portfolio Value Over Time")

plt.xlabel("Date")

plt.ylabel("Portfolio Value ($)")

plt.grid(True)

plt.tight_layout()

plt.savefig("portfolio_value_over_time.png")

plt.show()

Portfolio Value Over Time

Beyond raw returns, it’s important to evaluate how efficiently the strategy generated returns relative to the volatility of outcomes. We compute the Sharpe Ratio for this purpose.

# After final portfolio value is printed

returns = [trade[4] for trade in trade_log if trade[4] != 0]

mean_return = sum(returns) / len(returns)

stddev_return = (sum([(r - mean_return)**2 for r in returns]) / len(returns))**0.5

sharpe_ratio = mean_return / stddev_return if stddev_return != 0 else 0

print(f"Sharpe Ratio: {sharpe_ratio:.2f}")Sharpe Ratio: 0.20Finally, we overlay buy and sell signals on the closing price chart, showing exactly when trades occurred and the returns achieved on each.

# Plotting Buy/Sell signals on Close price

plt.figure(figsize=(14, 6))

# Plot the Close Price with a lower zorder

plt.plot(df.index, df["Close"], label="Close Price", color="blue", zorder=1)

# Plot Buy and Sell signals with a higher zorder

for action, date, price, shares, return_pct, portfolio_value, fee in trade_log:

if action == "BUY":

# Scatter plot for Buy signal

plt.scatter(date, price, marker='o', color='orange', s=100, label="Buy Signal" if 'Buy Signal' not in plt.gca().get_legend_handles_labels()[1] else "", zorder=2)

plt.annotate(f"BUY", (date, price), textcoords="offset points", xytext=(0, 10), ha='center', fontsize=10, color='orange', zorder=3)

else:

return_color = 'lime' if return_pct > 0 else 'red' # Green for positive return, red for negative

# Scatter plot for Sell signal

plt.scatter(date, price, marker='v', color=return_color, s=100, label="Sell Signal" if 'Sell Signal' not in plt.gca().get_legend_handles_labels()[1] else "", zorder=2)

# Annotate with return percentage (if available)

plt.annotate(f"SELL \n {return_pct:.2f}%", (date, price), textcoords="offset points", xytext=(0, -30), ha='center', fontsize=10, color=return_color, zorder=3)

# Set chart title and labels

plt.title("Trading Simulation with Buy/Sell Signals and Return Percentages")

plt.xlabel("Date")

plt.ylabel("Close Price ($)")

# Add legend

plt.legend()

# Add grid for better visualization

plt.grid(True)

# Tight layout to avoid clipping

plt.tight_layout()

# Save and display the plot

plt.savefig("trading_simulation_2024_2025_with_return.png")

plt.show()

Trading Simulation with Buy/Sell Signals and Return Percentages

This annotated plot adds interpretability to the model’s predictions:

Orange dots indicate buy signals.

Green/red triangles show sell decisions and highlight positive or negative returns respectively.

Annotations give context for each action, showing not just timing but also impact.

Thank you for reading this article and following along with the trading simulation. I hope you found this insightful and helpful for your journey into algorithmic trading.

You can access the full code for this simulation, along with other related resources, on my GitHub repository. Also check out the following article on How we trained the random forest model.